does personal cash app report to irs

Starting in 2022 mobile payment apps like Venmo PayPal Cash App and Zelle are required to report business transactions totaling more than 600 per. IRS would not tax any transfers that take place between friends and family members.

Irs Has New Ways Of Taxing Cash App Transactions

Certain Cash App accounts will receive tax forms for the 2021 tax year.

. Reporting Cash App Income. Does a Personal Cash App report to the IRS. Log in to your Cash App Dashboard on web to download your forms.

People report the payment by filing Form 8300 Report of Cash Payments Over 10000 Received in a Trade or Business PDF. By Tim Fitzsimons. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to the.

New year new tax laws. Now cash apps are required to report payments totaling more than 600 for goods and. If it is a gift by the legal tax definition you do not have to report it as income.

Beginning January 1 2022 all mobile payment apps including Venmo PayPal and Cash App must report. Therefore the new law also does not apply to other apps like Venmo or Cash App. Jan 05 2022 The IRS is cracking down on payments made through third-party apps requiring platforms like Venmo PayPal and Cash App to report transactions if they exceed 600 in one.

Do personal checks get reported to the IRS. Financial Aid Financial Aid For College Fafsa As of January 1 2022 there are new rules for cash apps and electronic payment systems. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle.

Well the Internal Revenue Service IRS now wants to get in on the action. The American Rescue Plan includes a new law that requires cash apps like Venmo and Cash App to report payments of 600 or more to the IRS. A person can file Form 8300 electronically using.

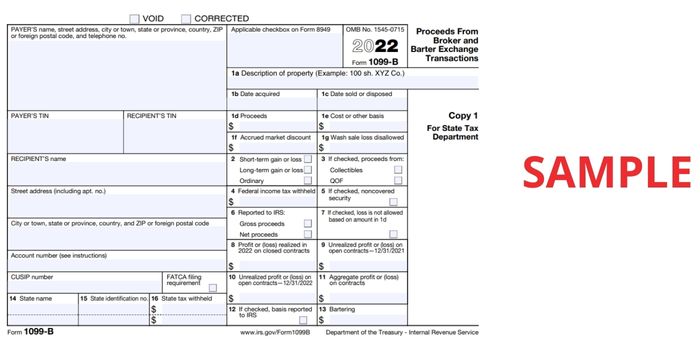

If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. KERO The IRS has designed new ways of taxing cash app transactions but misconceptions might be leaving some confused about who these changes. Cash App Support Tax Reporting for Cash App.

Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. You just need to report on your tax return any income from selling items offering service earnings. However laws passed in March 2021 as part of the American Rescue Plan Act state that these apps now must report any business transactions that exceed 600 in a given year.

The reporting requirements for digital payment apps such as Venmo and PayPal have changed. Does cash APP report to the IRS.

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

Cash App Taxes Review 2022 Formerly Credit Karma Tax

Tax Changes Coming For Cash App Transactions

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Changes To Cash App Reporting Threshold Paypal Venmo More

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

What Churches Need To Know About Venmo Paypal And Cash App Changes Outreachmagazine Com

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Proposed 600 Bank Account Reporting Rule Won T Change Current Cash App Tracking Don T Mess With Taxes

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Does Cash App Report Your Personal Account To Irs

Cash App Tax Forms All Tax Reporting Information With Cash App

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Coupons And Free Stuff

Venmo Paypal And Cash App Will Now Have To Report Transactions Totaling More Than 600 To The Irs Daily Mail Online

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs